#5 Building Centralised Crypto Exchanges

Crypto is a decentralised entity but yet in order to allow the masses to participate in economic freedom in order to buy crypto currencies, centralised crypto exchanges were built.

What are centralised crypto exchanges ?

These are platforms which allow users to buy/sell listed crypto currencies by using their fiat currencies. Users buy from the exchange and the crypto currency is held in custodial wallets of the exchange which means that technically the crypto currency is owned by the exchange and is reserved in the name of the like banks were banks own the money and not the user. There are two ways a user can buy a crypto currency :

On Chain through decentralised exchanges : Users can buy crypto currency on decentralised exchanges by using their own wallets (eg : meta mask ) and have complete ownership of the crypto currency. In this, users exchange crypto currency on the blockchain and have to pay the mining/gas fees to enable that transaction on the block chain.

Off Chain through centralised exchanges : Users can buy crypto currency from each other through centralised exchanges(Eg : Wazir X, Coin DCX, Binance) and the ownership is not transferred on the blockchain but in the database of the centralised exchange leading to zero blockchain gas/mining fees.

What is the problem that Centralised Crypto Exchanges are solving ?

Enable easy to use interfaces to allow retail users to buy crypto currencies with fiat currencies.

Government compliance and regulations to allow users to purchase crypto currencies as an investment instrument.

Increase micro transactions of crypto currencies without the problem of paying high blockchain gas/mining fees.

Improve consumer trust by listing crypto tokens after proper due diligence.

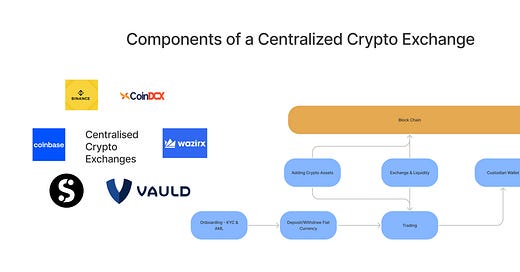

What are the main components of a centralised exchange ?

Onboarding KYC & AML

Deposit/Withdraw

Addition of Assets

Crypto Operations

Custodial Wallet

Peer to Peer Trading

Blockchain Crypto Exchange

Onboarding KYC & AML

This is a critical step to comply with government regulations and allow users to exchange crypto currency with fiat currencies through their centralised finance instruments such as bank accounts and credit/debit cards. This also enables a layer of security to prevent financial frauds and is compliant with government rules to weed out bad actors. The various steps in the onboarding KYC flow is :

Establish the government identity of the account being created with unique identification numbers such as PAN and Aadhar

Establish digital photo identity to establish a valid digital photograph through a government issued identity card

Establish through facial recognition that the person creating the account is the same person whose details have been submitted.

Check with the AML list in the concerned country whether the account created matches with that list to block access of such accounts.

This is a hugely intensive tech system and requires lots of development effort and some of the centralised exchanges think that developing deep solutions in this space can give them competitive edge.

Deposit/Withdraw fiat currency

This function is required to connect centralised finance to decentralised finance where one can convert their fiat money into cryptocurrencies and vice versa. The main steps in this are as follows :

Enabling different fintech instruments to deposit money in the wallet of the user on the centralised exchange.

Use the KYC & AML function to figure out whether users have the option to withdraw money to their financial instruments.

This part has huge implications on customer support due to multiple failure points and hence reliability is the key here.

Addition of Crypto Tokens/Assets/Currencies

The fundamental reason why people come to a crypto exchange is to buy and invest in crypto currencies. In order to facilitate this whole process, addition of crypto assets are an integral part of the product. The various parts of the product are as follows :

Adding any token to an exchange has 3 aspects to consider to enable :

Buying the token on the block chain

Hold the token in custodial wallets of the exchange

Enabling the users to send and receive the token on the block chain to different wallet address

In order to add a token the exchange has to provide the following compatibility :

Enable support for the block chain (eg : etherium , solana) of the token to list the token

Compatibility with the token standard(Eg : ERC-20, ERC 1170) of the listed token on the chain

Integrating the token to the exchange if the above two are figured out.

The other additional task that needs to be performed is the due diligence on the token to enable trust for the users .

Trading

Crypto exchanges enable peer to peer trading to minimise transactions on the blockchain to allow near instant trading and also minimise the high network fees which needs to be paid for on chain transactions for the users. Users trade different crypto currency pair among themselves and the order book is maintained in the database of the centralised exchange. There are 3 major operations here :

Buy crypto with fiat currency

Swap one crypto currency for another

Sell crypto currency to get fiat currency

All these three trades are established via an order book and work on the same principles where consumers buy and sell different pairs enabling a peer to peer trade.

Exchange & Liquidity

The centralised exchange cannot provide all the liquidity by peer to peer trading only and either owns a decentralised exchange or connects to a decentralised exchange in order to increase liquidity and determine pricing. Lets look at the following scenarios :

When buyers of a particular token are more than sellers of the token on the centralised exchange then the additional liquidity to fulfil buy orders is obtained from the exchange by buying crypto currencies on the block chain.

The price is determined by the exchange depending on the supply demand conditions for a particular asset on the exchange.

Custodian Wallet

Additional security layers are added to wallets which hold all the crypto currencies bought by the exchange. All the crypto currencies are thus owned by the exchange and they maintain the user’s assets in their database.

This innovation has helped normal retail users to enjoy the innovation of the crypto world. Do let me know in comments or reach out at linkedin if you want to discuss further.